Scale AI is on a mission to provide leading AI developers with human-annotated training data that mitigates the missteps inherent to large-scale models. Over a year ago, Google invested at least $120 million to leverage the company’s work into a faster, more reliable Gemini LLM. An additional $200 million worth of training data remained on the table for further development this year.

That’s all changed now, though, after Meta announced opening a 49% stake in the up-and-coming data provider. The deal roughly doubles Scale AI’s value to $29 billion — which is a lot of money and market power — but that might not be the investment’s biggest effect. In addition to forcing Google to cut ties with the data provider, the investment has sent ripples through the development industry, causing AI leaders to rethink what companies they partner with.

The curse of success

Pick your battles — and allies — carefully

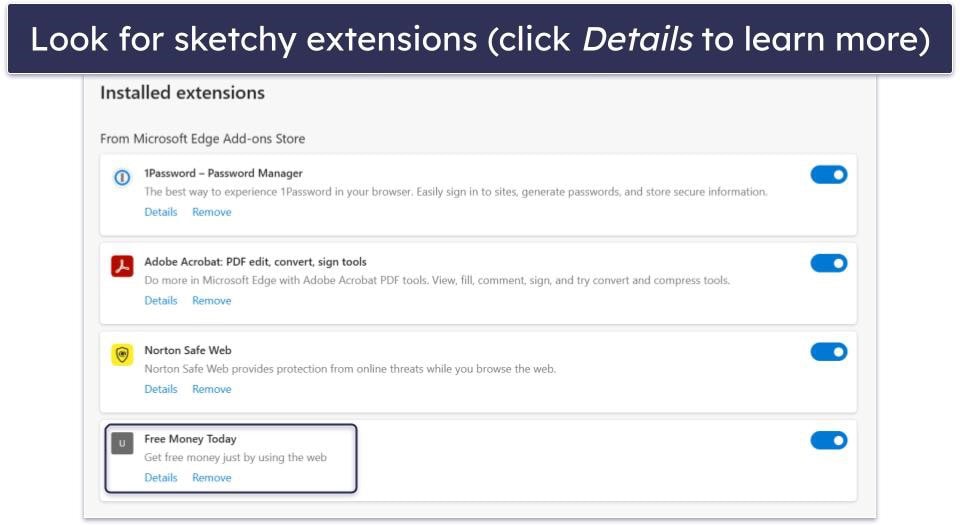

More consumers than ever understand how critical data privacy and security are to personal and financial well-being. Corporations know it even more intimately. Closely guarded secrets are the lifeblood of cutting-edge tech development, after all, and nearly no amount of money can make up for a competitor gaining access to trade secrets.

That’s why Scale AI’s massive, multi-billion-dollar partnership with global tech giant Meta has sent competitors running for the hills. Unlike OpenAI enlisting Google’s powerful supercomputers to run its models, sharing data annotation services like Scale AI worries companies leading the AI charge. As one Nasdaq analyst described, Google “continuing to work with Scale AI would be like Ford letting GM’s top engineers and strategists walk around its secret R&D facility for next-generation vehicles.”

A schism in the church of AI

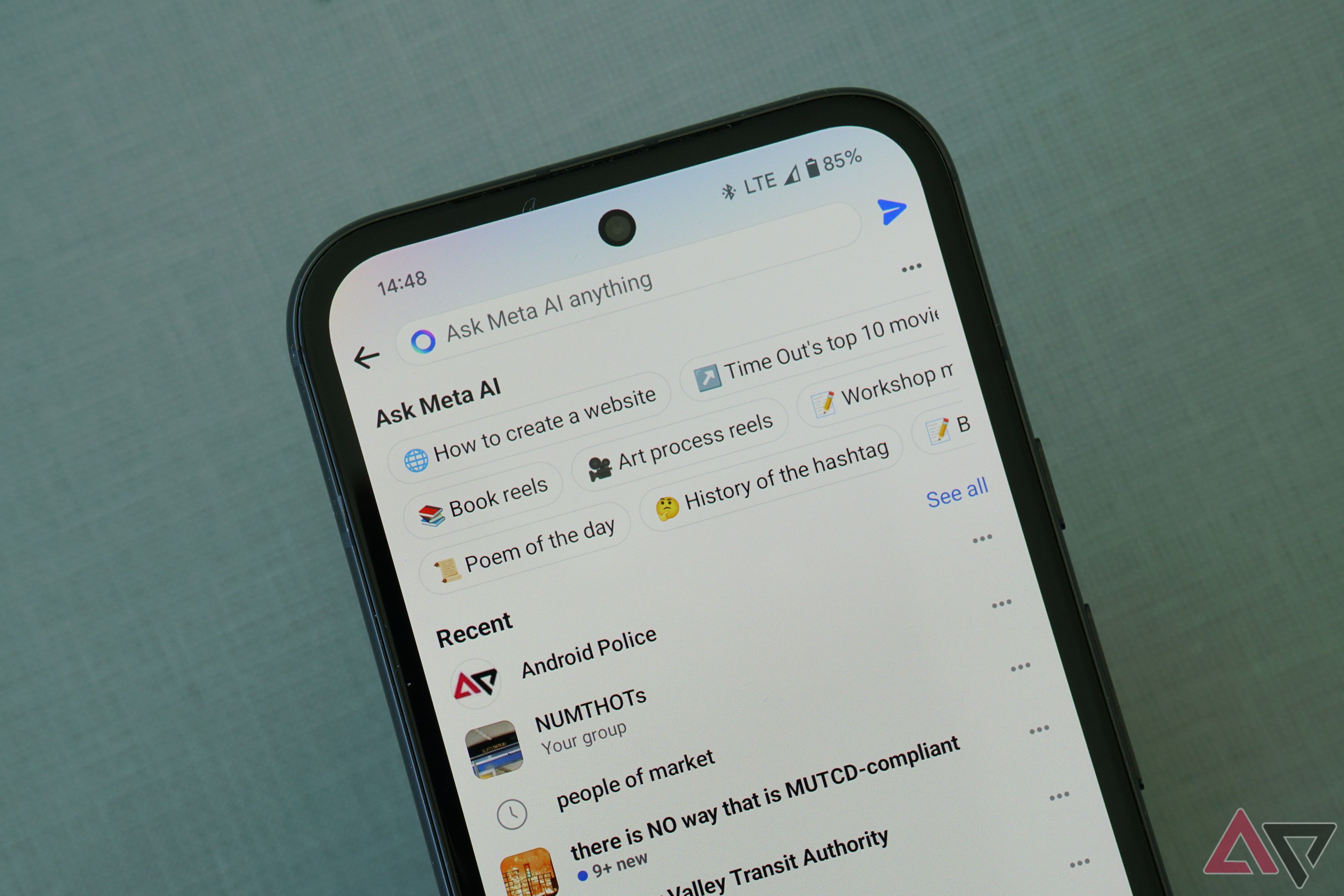

Get ready for Meta AI to get better.

Sources told Reuters Google has already begun seeking a replacement for the company’s powerful services. It’s not the only Scale AI customer with that mindset, either, as both Microsoft and xAI are reportedly testing the waters with alternatives. The industry shakeup comes after OpenAI began phasing out its reliance on Scale AI months ago, according to insider sources. Now that Scale’s CEO will shift to working for Meta, competitors worry they can’t rely on the annotation startup to keep everyone’s best interests at heart.

Companies that compete with Meta in developing cutting-edge AI models are concerned that doing business with Scale could expose their research priorities and road map to a rival, five sources said. — Reuters

Scale does work with outfits outside consumer-facing AI development, such as self-driving automotive developers and US government interests, and plans to continue doing so. But Meta’s near-takeover of the increasingly in-demand field’s current leader provides opportunities for Scale AI’s rivals to take a piece of the pie.

Scale alternatives, including Labelbox and Handshake, are already fielding or anticipate seeing a huge surge in demand as AI companies look for their own personal data-annotation partner. As Jonathan Siddharth, Turing CEO, explains, “The Meta-Scale deal marks a turning point. Leading AI labs are realizing neutrality is no longer optional, it’s essential.”

In addition to Meta gaining increasingly exclusive access to advanced, human-reviewed datasets, the high-dollar deal benefits Scale AI investors, who are sure to be excited about the new $29 billion valuation.