There’s something about holiday deals that must be studied. Sales happen early in the year, but the air feels different by November.

An irrational part of you surfaces and convinces you that every price slash is reasonable. That’s how I ended up blowing a week’s worth of money on unnecessary items.

I remember ordering an electric $200 milk frother on Amazon last year, even though I don’t drink coffee.

There was no defense for someone who didn’t have an apartment at the time or real reasons to justify buying something that fancy.

This year, I’m approaching shopping with a clear mind and eyes. I’ve made these seven changes to my mobile devices ahead of the upcoming Black Friday sales.

Turn off distractions

Shopping apps send flash during sales, such as “Hurry, only two left!” or “Your cart expires soon.” They arouse curiosity and excitement.

From there comes impulse spending. I disable notifications for all my shopping apps to block these distractions.

I’ll open an app myself if I need to shop. But not before creating a low-dopamine environment.

You may have noticed how shopping platforms are built to overstimulate your brain with colors and upbeat sounds.

They create the sense that something exciting is about to happen. But it’ll happen at the expense of your wallet.

I do the exact opposite to counter the system. I’ll silence my phone, dim my screen brightness or enable greyscale mode, and play rain sounds from the Calm app.

It removes all auditory cues that signal incoming rewards and slows my stress levels. It’s harder for excitement-driven impulses to dominate my decisions in that state.

Audit wishlists before upgrading

I always ask myself if something I already own performs similar functions to a wishlist item at over 60% efficiency.

If yes, the new item doesn’t solve a real problem. It only upgrades an existing solution that works well enough. I learned this trick from a friend who works in the IT department.

Before his company buys new software, they ask: “Can our current tool still handle most of what we need?” Otherwise, upgrading would just create an unnecessary overlap and complicate management.

Likewise, that flagship phone I’ve been eyeing might not change my daily experience. Flashier specifications and AI features won’t matter if I only stick to basic tasks.

Yet, there’s nothing wrong with upgrading for pleasure if you can afford it. Sometimes, the joy of using something new is its own reward.

However, if you’re on a tight budget, avoid costly risks.

Use price history data as a hard gate

Price is a diabolical asset for shopping apps. It’s one variable that controls your wallet without raising suspicion.

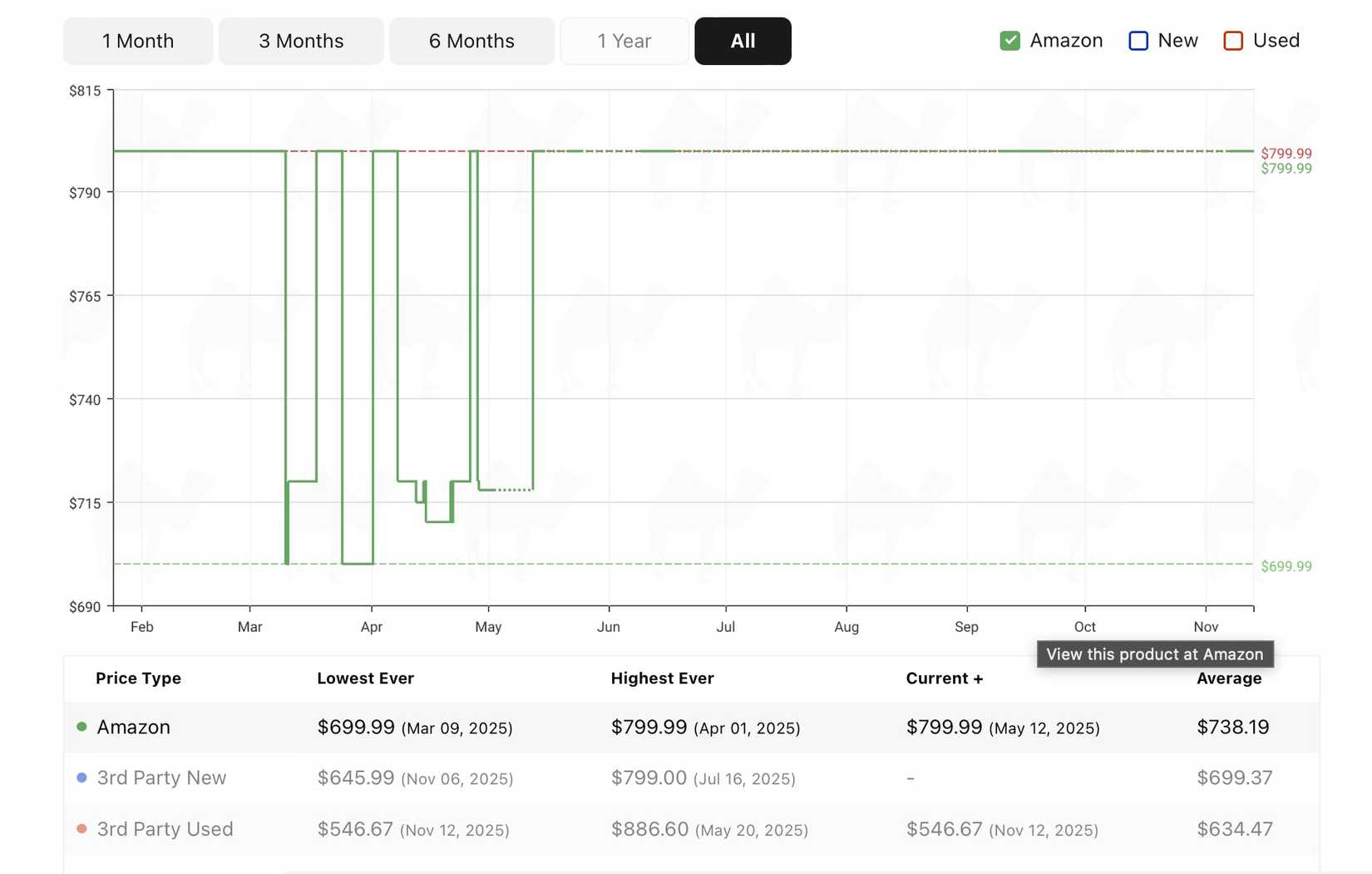

Most people don’t track it over time. That’s why apps sneakily sell the illusion of savings. You assume the current discount reflects a genuine drop. But an item has been cheaper shortly before.

The current deal is nothing special. Worse, the slashed figures may be fake and anchored to a list price that it rarely sells for.

A smartwatch may go from $199 to $99. Check the price history, and you’ll see how it’s been selling for $89 or $95 for months.

It’s why I pull up a three-to six-month chart on CamelCamelCamel. It gives me a clear view of fluctuations.

I treat this information as a hard gate. If the sale price is not the lowest point within that window, the purchase ends there.

Calculate true landing costs

Shopping from overseas has extra layers that no banner will show you. The price you see at first glance is never the real cost. You still have to deal with other deductions.

Individually, they’re scraps you’ll hardly miss. But they add up significantly, especially if you’re spreading expenses across multiple platforms.

Mind you, savings only count when you can account for every deduction. Otherwise, you’re just shifting cost into small invisible pieces that drain your budget.

YouTube videos on mini importation taught me to calculate true landing costs. That is, the actual amount I’ll pay in total and not the softened app price. It includes the Sale Price + Shipping + Import Fees + Foreign Exchange Loss (FX) + Card Percentage Charge.

You’ll see the breakdown before checkout. A personal rule is that the final amount must not cross 110% of my budget for each product. I’d hate to pay more for inefficiencies when I could find a better deal locally.

You won’t see FX losses until after banks process the payment. It’s what your bank or payment provider charges after you make a payment in a foreign currency.

Still, you can make estimations. Check what they charged for your last international transaction. Use that as your true rate.

Make a shopping list

If you fail to plan for Black Friday, you’ve planned to overspend.

Never drift into sales without a clear vision of what you need. You’ll be overwhelmed with choices and give in to impulses. Shopping apps will decide for you what you couldn’t do for yourself.

I make a list of non-negotiables in Google Keep or a physical journal, days before the sales. Even with a list, I may deviate.

Still, the odds that my spending spirals out of control are reduced significantly. It helps when I group items by order of necessity instead of lining them up at once.

Tier 1 contains high-priority items. Tier 2 covers things that make life easier but aren’t urgent, such as a second phone charger or kitchen tools. Tier 3 is mostly vanity wishes, like extra makeup or clothes.

I can only buy one item from Tier 2 or 3 if at least half of the items from Tier 1 are ticked off. That way, I delay gratification.

Set price ceilings within budgets

A price ceiling is the highest amount I’m willing to pay for a single item, no matter how good the discount looks. A budget, on the other hand, covers the total amount I plan to spend.

I may decide my total Black Friday budget is $300. I’ll put down $50 for earbuds, $100 for skincare, $50 for phone accessories, and $100 for an appliance.

A budget gives room for negotiations. I may justify an overpriced item by promising to spend less elsewhere.

However, a price ceiling draws a firm line around what each item is worth to me. If I’ve capped earbuds at $50, even a $55 pair that’s 40% off isn’t allowed.

The bottom line is that money can always be replaced. But discipline can’t be rebuilt as quickly. You won’t save effectively if you keep treating your limits as flexible.

Lock your money with strict apps

I used to be bad at saving. So I locked my money in fintech apps for a set period of time. I can’t make withdrawals until the duration ends.

However, most platforms only offer long-term locks of up to three months. You’ll hardly find anything that freezes your money for 24 hours or a week.

So, during short-term sales events, I move my shopping money from my main bank account into my wallet apps. I add a little extra for emergencies. Then I use app blockers to block my main banking app until the sale period ends.

Slower checkouts stop faster regrets

Over the past few months, I’ve managed to train myself and ditch the excitement that usually comes with sales season. It’s not hard to remain calm once you’ve built a system that works for you.

The best part is that you can extend that same mindset beyond Black Friday into your daily habits.

Deleting card details after every purchase is one of many ways I break overspending streaks. It stops reckless spending since I have to re-enter my card details every time.

I also break down my expenses across utilities, groceries, and side projects in budgeting apps.

Reaching my financial goals has been easier with these micro yet intentional steps.