The last decade hasn’t been kind to T-Mobile users’ personal data. Almost every year has seen some kind of breach, leak, or bug expose potentially sensitive customer information — as recently as last month — so it’s not exactly cynical to ask, “Which data breach is this check for, again?” At least, that’s what a decent swatch of Redditors are asking after receiving settlement remunerations of a paltry $56.

In this case, payouts are related to the 2021 breach that affected over 70 million users. The settlement was negotiated by Kroll, and you had to actively make a claim to get any money. Checks were predicted to be around $25 (or $100 for California residents), and only documented losses would garner claimants more cash. In other words, a low dollar amount isn’t entirely surprising, but as social media users have humorously noted, $56 is a small fee to receive in exchange for the privacy of your personal data (Source: Reddit via PhoneArena).

Your identity for a song

At least those most heavily impacted got more

Laughter, as they say, is the best medicine, and while it won’t help fight identity fraud, it might take some of the sting out of corporate data leaks. That appeared to be the philosophy behind Reddit’s sarcastic lampooning of just how much our individual privacy is worth to the corporate overlords.

In defense of T-Mobile and Kroll (not that either needs it), $56.54 is considerably more than the predicted $25 payouts. Apparently, fewer customers made claims than expected, leading the settlement pool to be stretched over a smaller number of claims. Those who did apply for settlement reparations do, most likely, appreciate the extra cash.

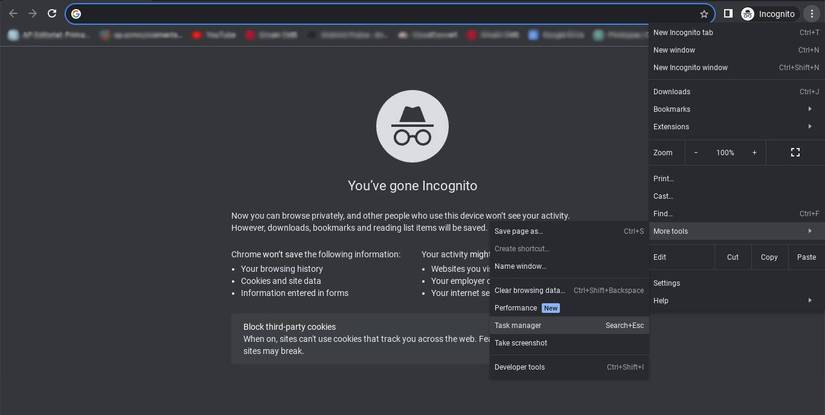

But there’s another point of contention wrapped up in that lower-than-predicted pool. As a decent number of social media users point out, class action lawsuit enrollments and their payouts often appear far from official. Carrier text messages can get spam-like over time, and settlement signup webpages might not look very legit. Even more confusing, some of these settlement checks were sent via Zelle, which hardly seems like a professional payment method at first glance. And while the Zelle payments have been real this time around, it’s yet another potential avenue for phishing.

As for the $56 checks, it appears that’s the original $25 figure multiplied by a factor of 2.26. That might also explain the $226 figure other users saw land in their account (although most didn’t specify their state of residence). Multiple others saw specific $288 payouts, which doesn’t necessarily fit into any obvious rubric. Still more affected customers have reported payments ranging from $300 to at least $800 over the last month.

The higher amounts likely applied to cases resulting in documented losses, such as time spent remedying identity theft and fees incurred by protecting data, like paid credit monitoring services. Payments that meet certain criteria, like a high enough dollar amount or claims billed as hourly, might also come with a request that the customer file a W9 for tax purposes. This, too, can come off like a scam, but if it comes from an official channel, it’s also real. Such an official channel even includes Zelle, in this instance, but be wary of clicking links in emails — for every legit Zelle communication, there’s probably another falsified one floating around somewhere.