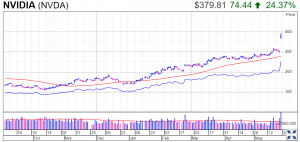

NVIDIA is the leading AI chip company. It has experienced a significant surge in its stock price, reaching an all-time high following its impressive performance in the fiscal first quarter and its optimistic forecast for future growth. The company’s predictions for the current quarter, with sales projected at $11 billion, represent a remarkable 64% year-over-year increase. This exceeded analysts’ expectations of $7.2 billion for the fiscal second quarter. The increasing demand for artificial intelligence (AI) technology is the extraordinary story propelling NVIDIA’s stock surge. CEO Jensen Huang revealed that the company is scaling production to meet the massive need for AI technology. It includes its industry-leading graphics processing units (GPUs). NVIDIA’s commitment to meeting the surging demand has captured investors’ attention, driving the stock to new heights.

Also Read: Revolutionizing Computer Graphics: NVIDIA to Unveil 20 AI Research Papers at SIGGRAPH 2023

Record-Breaking Performance and Soaring Stock Price

NVIDIA stock witnessed a staggering 24.4% surge, closing at $379.80 and peaking at $394.80 during intraday trading—a remarkable 29% increase. This surge propelled the stock past its previous record high of $346.47 in November 2021. Year to date, NVIDIA stock has already soared by an impressive 109% as of the last day’s close.

Also Read: US Stock Market Finds Boost From Artificial Intelligence (AI)

Positive Impact on Taiwan Semiconductor Manufacturing Company (TSMC)

NVIDIA’s success had a positive ripple effect, extending to its contract chipmaker, Taiwan Semiconductor Manufacturing (TSM). TSM stock experienced a significant boost of 12% to $100.95 following the news of NVIDIA’s stellar performance.

Also Read: How Did A Taiwanese Company Become The Backbone Of Modern AI?

Analysts Raise Price Targets and Predict Trillion-Dollar Valuation

After NVIDIA’s special beat-and-raise report, more than two dozen Wall Street analysts raised their price targets for NVIDIA stock. Several analysts even predicted that NVIDIA could become the next company to achieve a market value of $1 trillion. As of the close of Thursday’s trading session, NVIDIA boasted a market capitalization of $938 billion. Thus, solidifying its position as a prominent player in the market.

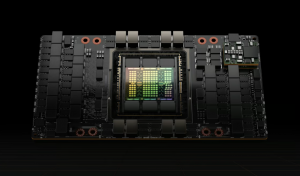

The Role of GPUs in NVIDIA’s Success

The accelerating demand for AI technology has been the driving force behind NVIDIA’s remarkable performance. The company’s graphics processing units (GPUs) have played a crucial role in meeting the computational requirements of advanced AI models. NVIDIA, an AI chip company, has been at the forefront of this technological transformation as the pioneer and trusted name in GPUs. Its impressive quarterly report evidences this.

Learn More: CPU vs GPU: Why GPUs are More Suited for Deep Learning?

AI Powers NVIDIA’s Data Center Segment

NVIDIA’s data center segment, encompassing semiconductors used in data centers, AI applications, and cloud computing, proved to be the star performer. The detail achieved record-breaking revenue of $4.28 billion, marking a remarkable 14% year-over-year increase and an 18% sequential increase. The robust results were primarily driven by the growing demand for generative AI and large language models utilizing NVIDIA GPUs for AI. Strong demand from large consumer internet companies and cloud service providers further contributed to the segment’s success.

Astounding Forecast and Investing Considerations

NVIDIA set a new high watermark for its data center segment and provided a mind-boggling forecast. Management expects revenue to reach $11 billion in the current quarter. Thus, representing a remarkable 33% year-over-year growth and potentially becoming NVIDIA’s best quarter ever. However, potential investors must consider the lofty valuation. The stock trades at 164 times trailing earnings and 27 times sales, which may deter value investors seeking more conservative multiples.

Our Say

NVIDIA’s exceptional performance in the fiscal first quarter, driven by the skyrocketing demand for AI technology, has propelled its stock price to record-breaking levels. The company’s optimistic forecast and dominance in the graphics processing unit (GPU) market have garnered significant attention from investors and analysts. While the lofty valuation may raise caution for some, NVIDIA’s position as a technological leader and its ability to meet the growing demand for AI technology make it a formidable player in the industry. With a strong foundation and promising prospects, NVIDIA, an AI chip company, is well-positioned for continued growth and success in the evolving world of artificial intelligence.