Recently, I got a message of a new unknown transaction done on my credit card. I raised a dispute against the transaction. Within, 10 minutes my dispute was accepted and the transaction got cancelled. The same day, I saw the product recommended to me as Chip Card and the tagline read “Make your transactions safer”. I ended up taking up this service.

How did the bank manage to convert a customer from potential attrition to a new X-sell lead? Definitely, streamlining of the process helped the banks take quick calls. But more importantly big data has helped banks to recognize each customer and identify his needs. After reading this article you will be forced to think on what grounds did the bank shortlist you for a particular offering every single time you become a X-sell lead.Was this your bank balance, your transactions with grocery vendor, your newly purchased car loan or ,merely, your last complain?

[stextbox id=”section”]Introduction : [/stextbox]

I am sure you might have noticed a tab in your online bank account which says “Products for You” and “Deals for you”.How are the banks almost always bang on.

If you are about to say bank use propensity of a customer to buy the new product to make X-sell offers, you know just a fraction of the whole story. These calculations have modified a lot in last 5-7 years. Today, banks perform an infinite number of calculations on a single customer to come up with the next best product for him/her. This primarily includes 4 main factors :

1. How risky is the customer if he takes up the proposed product?

2. What is the propensity of the customer to take up this product?

3. How profitable is the customer expected to be if he takes up the new proposed product?

4. What is the utility of the value propositions of the new product to the customer?

The first three points focus on the profitability for the bank and the last point focuses on the use of this product for the customer. In a well baked strategy both profitability and customer Centricity need to be balanced. None of the factors mentioned can be analyzed alone to get to the final strategy. All the dimensions need to be considered before making an offering. We will discuss this analysis done by banks in more detail in the following sections.

[stextbox id=”section”]Metrics considered for targeting : [/stextbox]

Lets take an example to make this discussion more relevant. Lets say, Bank X offers three types of credit cards i.e. Miles Card, Rewards Card and Cash Back Card. Bank X wants to build a strategy to X-sell a second card to its existing Customer base.

Using Propensity of a customer to buy a product for targeting :

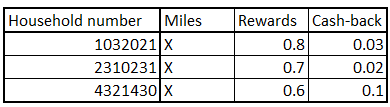

Propensity prediction is based on past trends of product take up by various segments of customers.Following is an illustrative table of the probabilities of Miles card holder taking up other two products :

The advantage of using propensity of a customer to take up a product for targeting is that the overall responders are expected to be higher. However, this approach does not consider the quality of the responder. For instance, based on propensity we target household “1032021” (say A) and not “2310231” (say B). But if household B generates 10 times the revenue of A, if responded, then B was actually a better target. Hence, we see the need of incorporating the lifetime value or revenue generated by each customer along with the propensity factor.

Using lifetime value of household along with the propensity :

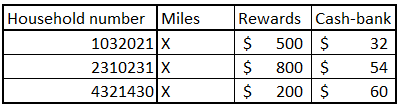

With the expected revenue generated by each household, it is possible to tabulate the expected value generated by finding a product of propensity to buy and revenue generated. Following is an illustrative table of expected values when targeted with a Rewards Card or Cash-back Card.

Clearly, household “1032021” (say A) has a lower expected value for Rewards Card compared to “2310231” (say B). If the targeting were made only based on propensity values, we might have targeted household with lower expected value. This matrix gives a more complete picture compared to only propensity, but we still have not covered some other dimensions. For instance, we are still not sure on the utility of cards for each customer. Say, household A prefers a Rewards card and household B prefers a Cash Back card. If we still target customer B with Rewards card, it is merely because of the additional profitability and not customer utility. If it was a monopoly market, it wouldn’t have mattered. But as we know, its a highly competitive market and other bank can recognize this need of the customer and offer need based card. If this happens, the primary bank looses household B because it targeted the household with a product which was more profitable for the bank but not as per the need of the customer.

Using Customer preference/Utility for targeting:

If a customer is targeted only based on expected value, this can lead to a higher revenue for the bank but will not help in attaining customer delight. Customer delight might have a low immediate financial impacts but on a longer run, it makes a big difference in a fierce market of banks fighting with each other for wallet share. To incorporate the angle of customer centricity, we add a metric of utilization index for each card for each customer.

Lets take an example, say the major difference between Miles card and Rewards card is the cash limit. For miles card , the cash limit is $10k and for the rewards card is $20k. Any cash spent over limit is chargeable. If a customer spends more than $10k on a Miles card regularly, he is giving a penalty everytime he oversteps this line. Rewards card, hence, becomes a good value proposition for this customer. In case, this customer has a high expected value as well, this customer is indeed the best target for Rewards card.But targeting customers just based on their preference might not be profitable for the bank.

As we saw each of the dimension had its pros and cons. Let’s make this more interesting and analyze customer in more than one dimension. This is what Banks do for targeting. There are multiple dimensions on which a customer is analyzed before targeting. No single dimension gives optimal targeting strategy.

[stextbox id=”section”]Targeting based on multiple dimension :[/stextbox]

Case 1 : Only Expected Value is considered :

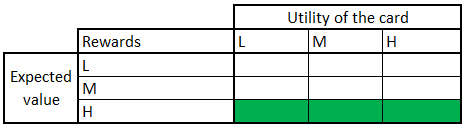

By targeting only high expected value customers, we will end up targeting only customers falling in the last row of the following table.

Such strategy leads to target households (H on expected value and L on utility) who are least interested in this kind of offers and might as well result in household attrition.

Case 2 : Expected Value and Customer Preference considered together :

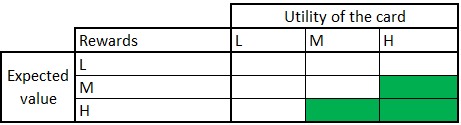

Let’s try to include Utility as well in targeting.Following targeting is an example of how cross grid helps bank in targeting decision making.

As you can see, instead of households with low preference and high expected value this targeting includes household with high product preference and medium expected value. This might lead to immediate financial negative impact but will lead to higher customer satisfaction and , thereby, higher customer lifetime value.

Adding more dimension leads to a precise targeting. Other than expected value, risk of a customer defaulting is as well considered as an additional dimension. There are strict risk cut-offs for such targeting . Additionally, Legal authorities restricts banks from discriminating targeting some social class as well. Every targeting strategy needs to be unbiased to these restricted classes.

[stextbox id=”section”]End Notes:[/stextbox]

The examples taken in this article are illustrative. Also, the card offered to me recently, mentioned in the start of this article, was a trigger based X-sell campaign. We will cover the difference between trigger based campaigns and periodic batch campaigns in some other article as it is not the focus of this article.

Share with us any interesting sales pitch your bank made to you. Do you think there are any other dimensions which should be included for targeting of X-sell campaign? Did you find the article useful? Do let us know your thoughts about this article in the box below.