This article was published as a part of the Data Science Blogathon.

Introduction

A loan default occurs when a borrower takes money from a bank and does not repay the loan. People often default on loans due to various reasons. Borrowers who default on loans not only damage their credit but also risk being sued and having their wages garnished. Let’s take a look at the types of defaults that happen and understand the various reasons why people take loans and learn how predicting loan default will work.

Source: Pexels.com

Types of Default

A secured debt default can occur, such as with a mortgage loan secured by a property or a business loan secured by the company’s assets. If you do not make your mortgage payments on time, the loan may default. Similarly, if a corporation issues bonds (essentially borrows money from investors) and cannot fulfil coupon payments to bondholders, the company is in default. Unsecured debt defaults, such as credit card debt, can also occur. The borrower’s credit and future borrowing capacities suffer due to default.

Why do People Take Loans? Why does Lending exist?

Many individuals utilize debt to pay for things they wouldn’t be able to buy otherwise, such as a home or a vehicle. While loans may be beneficial financial instruments when utilized correctly, they can also be formidable foes.

Lending is a vital tool that propels all enterprises and individuals worldwide to greater financial success. The need for capital has risen dramatically as the world’s economies become increasingly integrated and interdependent.

In the last decade, the number of retail borrowers, SMEs, and commercial borrowers has increased dramatically. Though most financial institutions have seen an increase in revenue and profit due to this rising trend, not everything is green. In recent years, there has been an increase in loan defaults, which has already begun to affect the bottom lines of several financial institutions.

Let us work with a sample dataset to see how predicting the loan default works.

The Data

An organization wants to forecast who would default on a consumer lending product. Based on what they’ve seen, they have data on previous client behavior. As a result, when they gain new consumers, they want to know who is riskier and who isn’t.

The data contains demographic features of each customer and a target variable showing whether they will default on the loan or not.

First, we import the libraries and load the dataset.

import numpy as np # linear algebra import pandas as pd # data processing, CSV file I/O (e.g. pd.read_csv)

import matplotlib.pyplot as plt import seaborn as sns %matplotlib inline sns.set_theme(style = "darkgrid")

Now, we read the data.

data = pd.read_csv("/kaggle/input/loan-prediction-based-on-customer-behavior/Training Data.csv")

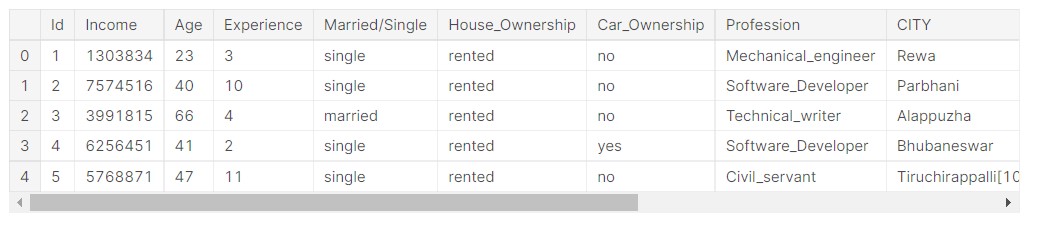

data.head()

Output:

All the dataset columns are not visible here, but I will share the link to the notebook, so please check it from there.

Understanding the Dataset

First, we start with understanding the data set and how is the data distributed.

rows, columns = data.shape

print('Rows:', rows)

print('Columns:', columns)

Output:

- Rows: 252000

- Columns: 13

So, we see that the data is 252000 rows, that is 252000 data points and 13 columns, that is 13 features. Out of13 features, 12 are input features and 1 is output feature.

Now we check the data types and other information.

data.info()

Output:

RangeIndex: 252000 entries, 0 to 251999 Data columns (total 13 columns) # Column Non-Null Count Dtype --- ------ -------------- ----- 0 Id 252000 non-null int64 1 Income 252000 non-null int64 2 Age 252000 non-null int64 3 Experience 252000 non-null int64 4 Married/Single 252000 non-null object 5 House_Ownership 252000 non-null object 6 Car_Ownership 252000 non-null object 7 Profession 252000 non-null object 8 CITY 252000 non-null object 9 STATE 252000 non-null object 10 CURRENT_JOB_YRS 252000 non-null int64 11 CURRENT_HOUSE_YRS 252000 non-null int64 12 Risk_Flag 252000 non-null int64 dtypes: int64(7), object(6) memory usage: 25.0+ MB

So, we see that half the features are numeric and half are string, so they are probably categorical features.

Numerical data is the representation of measurable quantities of a phenomenon. We call numerical data “quantitative data” in data science because it describes the quantity of the object it represents.

Categorical data refers to the properties of a phenomenon that can be named. This involves describing the names or qualities of objects with words. Categorical data is referred to as “qualitative data” in data science since it describes the quality of the entity it represents.

Let us check if there are any missing values in the data.

data.isnull().sum()

Output:

Id 0 Income 0 Age 0 Experience 0 Married/Single 0 House_Ownership 0 Car_Ownership 0 Profession 0 CITY 0 STATE 0 CURRENT_JOB_YRS 0 CURRENT_HOUSE_YRS 0 Risk_Flag 0 dtype: int64

So, there is no missing or empty data here.

Let us check the data column names.

data.columns

Output:

Index(['Id', 'Income', 'Age', 'Experience', 'Married/Single',

'House_Ownership', 'Car_Ownership', 'Profession', 'CITY', 'STATE',

'CURRENT_JOB_YRS', 'CURRENT_HOUSE_YRS', 'Risk_Flag'],

dtype='object')

So, we get the names of the data features.

Analyzing Numerical Columns

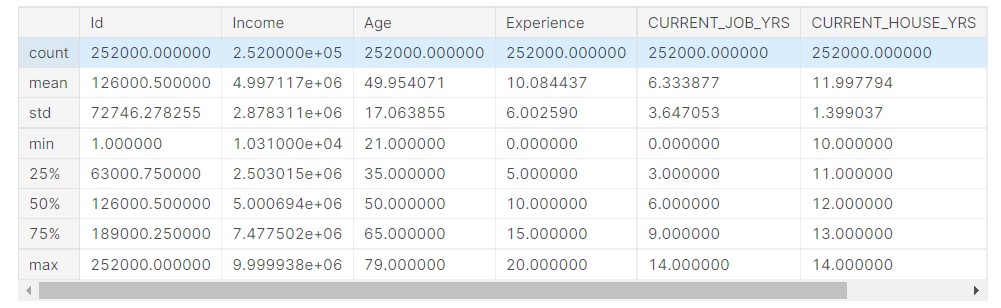

First, we start with the analysis of numerical data.

data.describe()

Output:

Now, we check the data distribution.

data.hist( figsize = (22, 20) ) plt.show()

Output:

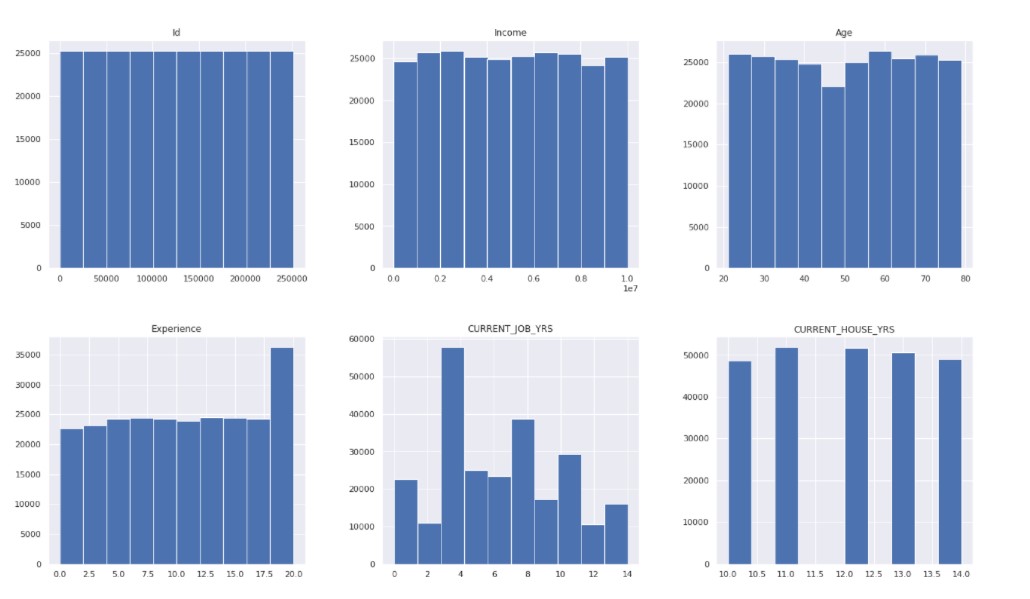

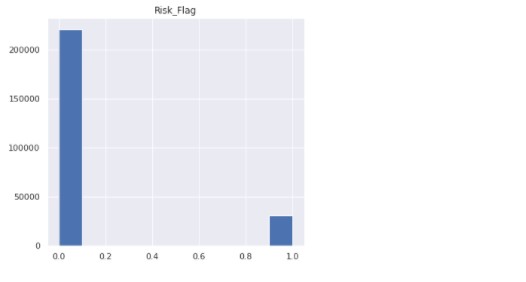

Now, we check the count of the target variable.

data["Risk_Flag"].value_counts()

Output:

0 221004 1 30996 Name: Risk_Flag, dtype: int64

Only a small part of the target variable consists of people who default on loans.

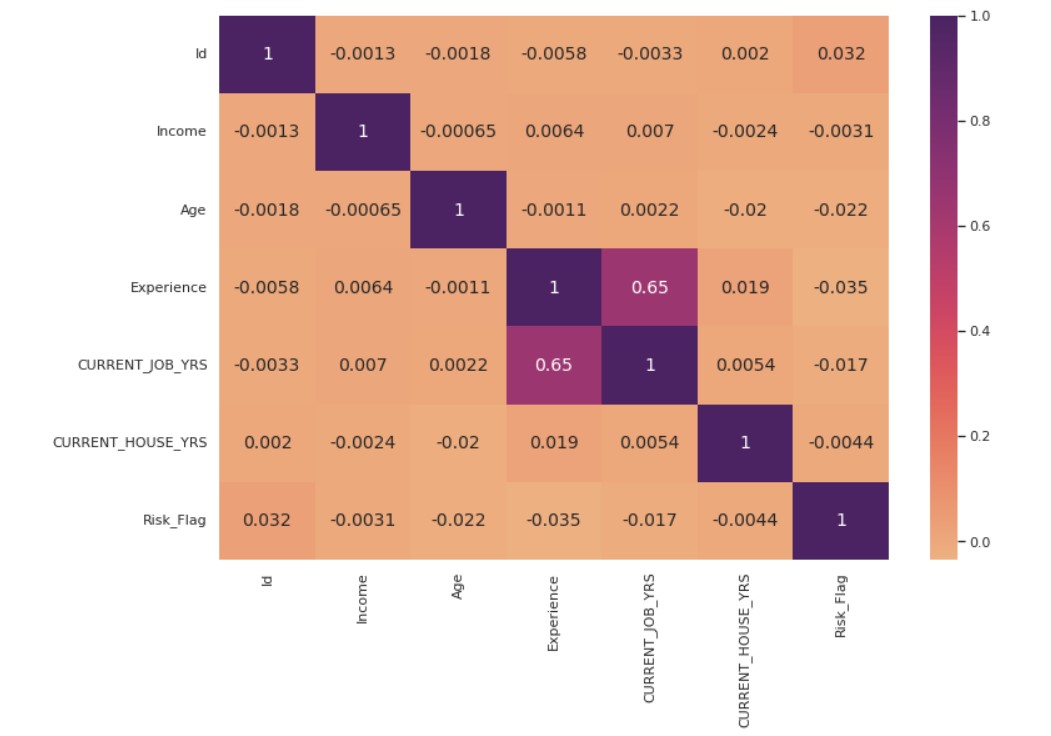

Now, we plot the correlation plot.

fig, ax = plt.subplots( figsize = (12,8) )

corr_matrix = data.corr()

corr_heatmap = sns.heatmap( corr_matrix, cmap = "flare", annot=True, ax=ax, annot_kws={"size": 14})

plt.show()

Output:

Analyzing Categorical Features

Now, we proceed with the analysis of categorical features.

First, we define a function to create the plots.

def categorical_valcount_hist(feature):

print(data[feature].value_counts())

fig, ax = plt.subplots( figsize = (6,6) )

sns.countplot(x=feature, ax=ax, data=data)

plt.show()

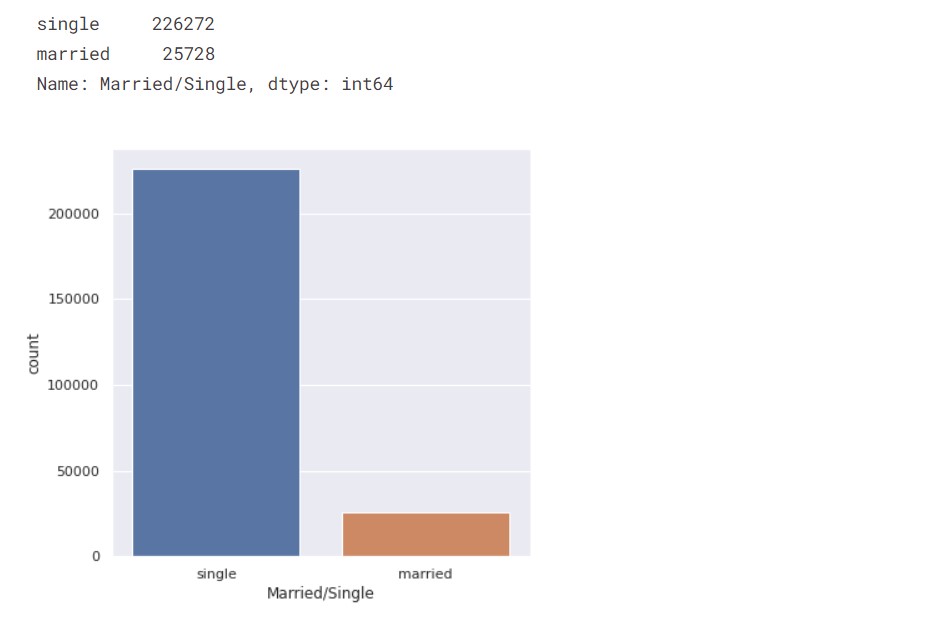

First, we check the count of married people vs single people.

categorical_valcount_hist("Married/Single")

Output:

So, the majority of the people are single.

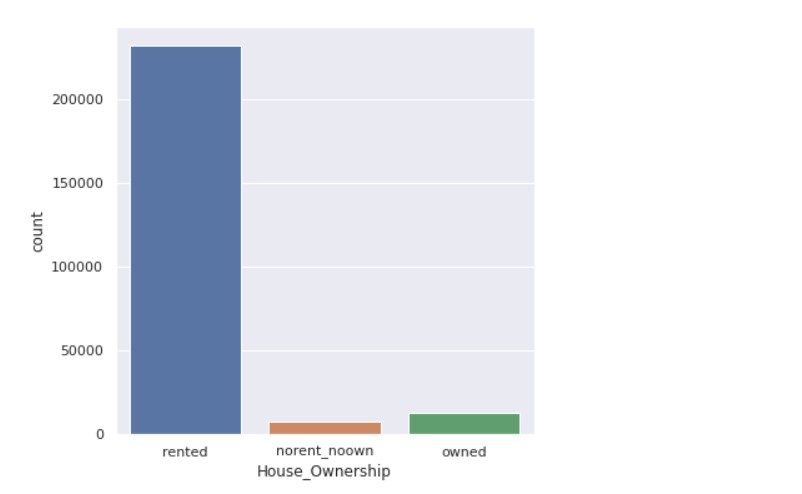

Now, we check the count of house ownership.

categorical_valcount_hist("House_Ownership")

Output:

Now, let us check the count of states.

print( "Total categories in STATE:", len( data["STATE"].unique() ) ) print() print( data["STATE"].value_counts() )

Output:

Total categories in STATE: 29 Uttar_Pradesh 28400 Maharashtra 25562 Andhra_Pradesh 25297 West_Bengal 23483 Bihar 19780 Tamil_Nadu 16537 Madhya_Pradesh 14122 Karnataka 11855 Gujarat 11408 Rajasthan 9174 Jharkhand 8965 Haryana 7890 Telangana 7524 Assam 7062 Kerala 5805 Delhi 5490 Punjab 4720 Odisha 4658 Chhattisgarh 3834 Uttarakhand 1874 Jammu_and_Kashmir 1780 Puducherry 1433 Mizoram 849 Manipur 849 Himachal_Pradesh 833 Tripura 809 Uttar_Pradesh[5] 743 Chandigarh 656 Sikkim 608 Name: STATE dtype: int64

Now, we check the count of professions.

print( "Total categories in Profession:", len( data["Profession"].unique() ) ) print() data["Profession"].value_counts()

Output:

Total categories in Profession: 51 Physician 5957 Statistician 5806 Web_designer 5397 Psychologist 5390 Computer_hardware_engineer 5372 Drafter 5359 Magistrate 5357 Fashion_Designer 5304 Air_traffic_controller 5281 Comedian 5259 Industrial_Engineer 5250 Mechanical_engineer 5217 Chemical_engineer 5205 Technical_writer 5195 Hotel_Manager 5178 Financial_Analyst 5167 Graphic_Designer 5166 Flight_attendant 5128 Biomedical_Engineer 5127 Secretary 5061 Software_Developer 5053 Petroleum_Engineer 5041 Police_officer 5035 Computer_operator 4990 Politician 4944 Microbiologist 4881 Technician 4864 Artist 4861 Lawyer 4818 Consultant 4808 Dentist 4782 Scientist 4781 Surgeon 4772 Aviator 4758 Technology_specialist 4737 Design_Engineer 4729 Surveyor 4714 Geologist 4672 Analyst 4668 Army_officer 4661 Architect 4657 Chef 4635 Librarian 4628 Civil_engineer 4616 Designer 4598 Economist 4573 Firefighter 4507 Chartered_Accountant 4493 Civil_servant 4413 Official 4087 Engineer 4048 Name: Profession dtype: int64

Data Analysis

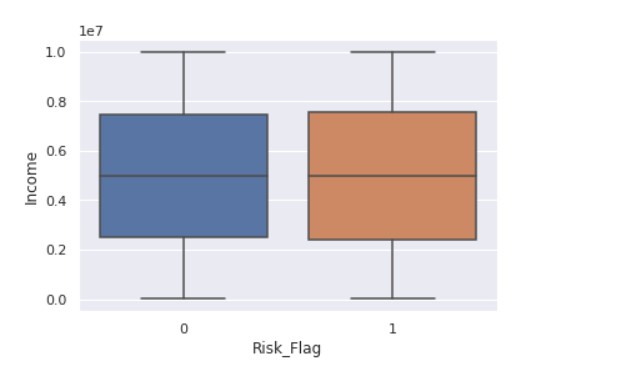

Now, we start with understanding the relationship between the different data features.

sns.boxplot(x ="Risk_Flag",y="Income" ,data = data)

Output:

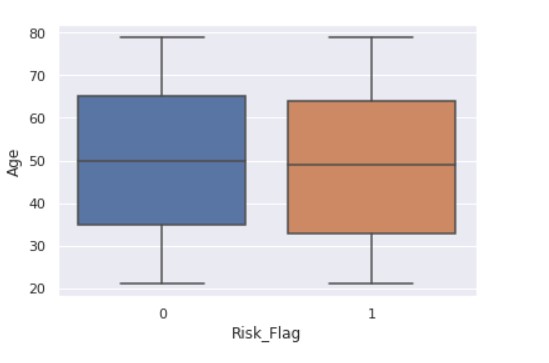

Now, we see the relationship between the flag variable and age.

sns.boxplot(x ="Risk_Flag",y="Age" ,data = data)

Output:

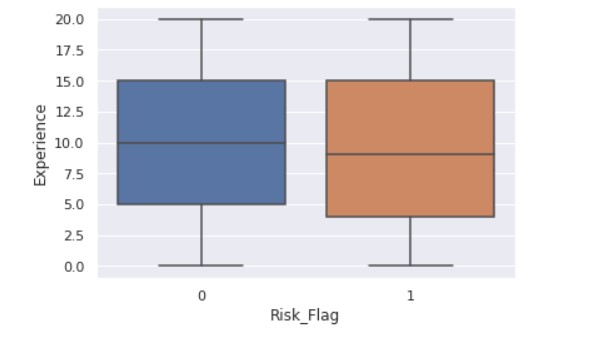

sns.boxplot(x ="Risk_Flag",y="Experience" ,data = data)

Output:

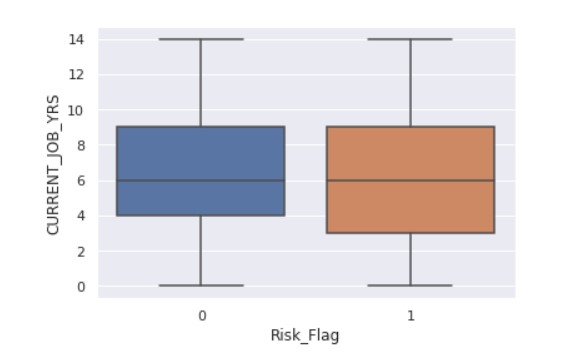

sns.boxplot(x ="Risk_Flag",y="CURRENT_JOB_YRS" ,data = data)

Output:

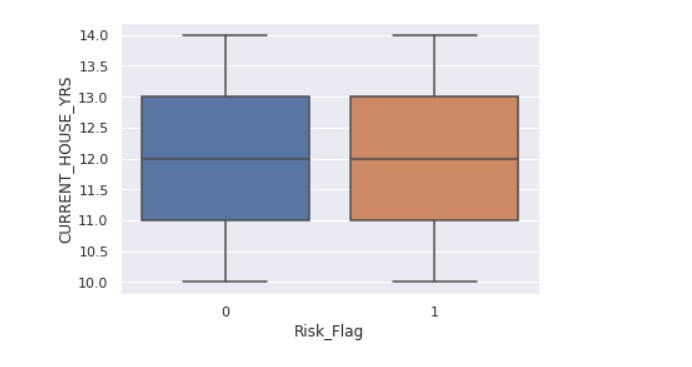

sns.boxplot(x ="Risk_Flag",y="CURRENT_HOUSE_YRS" ,data = data)

Output:

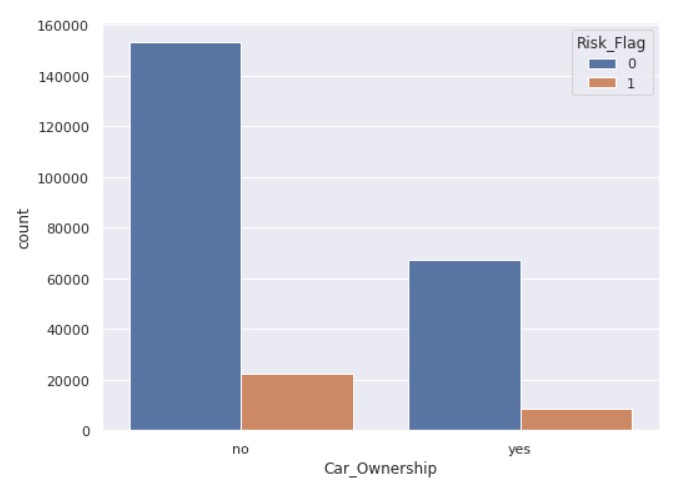

fig, ax = plt.subplots( figsize = (8,6) ) sns.countplot(x='Car_Ownership', hue='Risk_Flag', ax=ax, data=data)

Output:

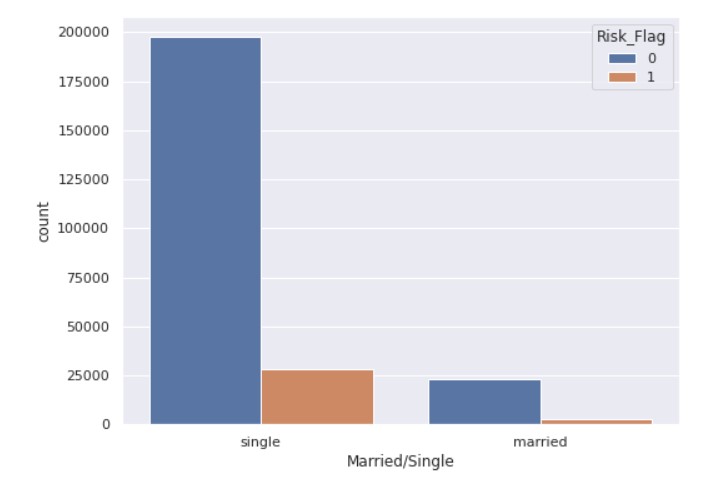

fig, ax = plt.subplots( figsize = (8,6) ) sns.countplot( x='Married/Single', hue='Risk_Flag', data=data )

Output:

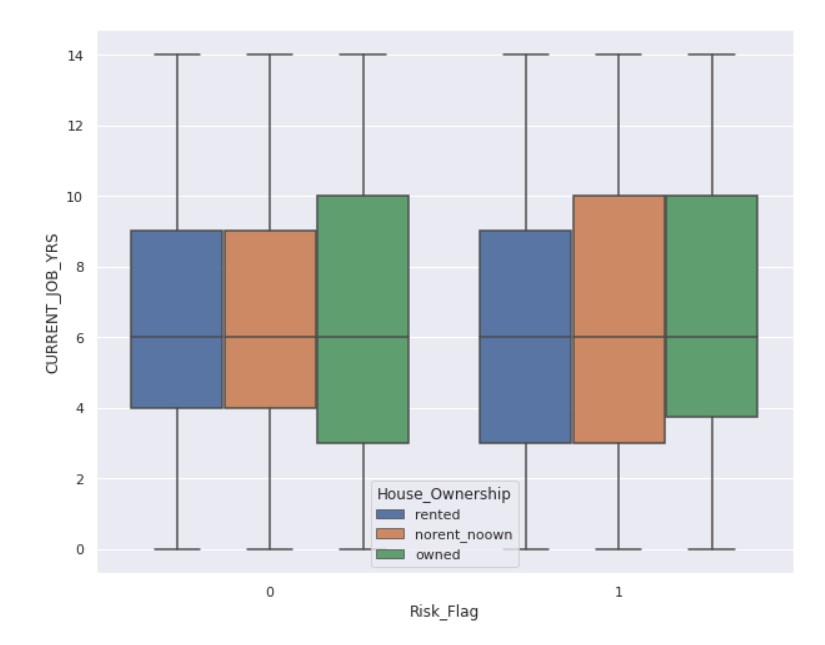

fig, ax = plt.subplots( figsize = (10,8) ) sns.boxplot(x = "Risk_Flag", y = "CURRENT_JOB_YRS", hue='House_Ownership', data = data)

Output:

Encoding

Data preparation is a required process in the field of data science before moving on to modelling. In the data preparation process, we must complete a number of tasks. One of these critical responsibilities is the encoding of categorical data. As we all know, most data in real life has categorical string values, and most machine learning models only deal with integer values or other values that can be understood by the model. All models, in essence, execute mathematical operations that may be carried out using a variety of tools and methodologies.

Encoding categorical data is the process of turning categorical data into integer format so that data with transformed categorical values may be fed into models to increase prediction accuracy.

We will apply encoding to the categorical features.

from sklearn.preprocessing import LabelEncoder from sklearn.preprocessing import OneHotEncoder import category_encoders as ce

label_encoder = LabelEncoder() for col in ['Married/Single','Car_Ownership']: data[col] = label_encoder.fit_transform( data[col] )

onehot_encoder = OneHotEncoder(sparse = False) data['House_Ownership'] = onehot_encoder.fit_transform(data['House_Ownership'].values.reshape(-1, 1) )

high_card_features = ['Profession', 'CITY', 'STATE']

count_encoder = ce.CountEncoder()

# Transform the features, rename the columns with the _count suffix, and join to dataframe

count_encoded = count_encoder.fit_transform( data[high_card_features] )

data = data.join(count_encoded.add_suffix("_count"))

data= data.drop(labels=['Profession', 'CITY', 'STATE'], axis=1)

After the feature engineering part is complete, we shall split the data into training and testing sets.

Splitting the data into train and test splits

The train-test split is used to measure the performance of machine learning models relevant to prediction-based Algorithms/Applications. This approach is a quick and simple procedure that allows us to compare our own machine learning model outcomes to machine results. By default, the Test set is made up of 30% of the real data, whereas the Training set is made up of 70% of the actual data.

To assess how effectively our machine learning model works, we must divide a dataset into training and testing sets. The train set is used to train the Machine Learning model, and its statistics are known. The second set is known as the test data set, and it is only utilized for predictions.

It is an important part of the ML chain.

x = data.drop("Risk_Flag", axis=1)

y = data["Risk_Flag"]

from sklearn.model_selection import train_test_split x_train, x_test, y_train, y_test = train_test_split(x, y, test_size = 0.2, stratify = y, random_state = 7)

We have taken the test size to be 20% of the entire data.

Random Forest Classifier

Tree-based algorithms are widely utilized in machine learning to handle supervised learning challenges. These algorithms are adaptable and can tackle virtually any issue (classification or regression).

When generating predictions on training samples in the areas they belong to, tree-based algorithms often employ the mean for continuous data or the mode for categorical features. They also generate forecasts with great accuracy, stability, and interpretability.

Random forest is a common tree-based supervised learning technique. It is also the most adaptable and user-friendly.

The approach may be used to address classification and regression issues. Random forest typically combines hundreds of decision trees and then trains each decision tree on a different sample of the data.

The random forest’s final predictions are calculated by averaging the forecasts of each individual tree. The advantages of random forests are numerous. Individual decision trees have a tendency to overfit the training data, but the random forest can alleviate this problem by averaging the prediction results from several trees. This provides random forests with a better prediction accuracy than a single decision tree.

Now, we train the model and perform the predictions.

from sklearn.ensemble import RandomForestClassifier from imblearn.over_sampling import SMOTE from imblearn.pipeline import Pipeline

rf_clf = RandomForestClassifier(criterion='gini', bootstrap=True, random_state=100)

smote_sampler = SMOTE(random_state=9)

pipeline = Pipeline(steps = [['smote', smote_sampler],

['classifier', rf_clf]])

pipeline.fit(x_train, y_train)

y_pred = pipeline.predict(x_test)

Now, we check the accuracy scores.

from sklearn.metrics import confusion_matrix, precision_score, recall_score, f1_score, accuracy_score, roc_auc_score

print("-------------------------TEST SCORES-----------------------")

print(f"Recall: { round(recall_score(y_test, y_pred)*100, 4) }")

print(f"Precision: { round(precision_score(y_test, y_pred)*100, 4) }")

print(f"F1-Score: { round(f1_score(y_test, y_pred)*100, 4) }")

print(f"Accuracy score: { round(accuracy_score(y_test, y_pred)*100, 4) }")

print(f"AUC Score: { round(roc_auc_score(y_test, y_pred)*100, 4) }")

Output:

-------------------------TEST SCORES----------------------- Recall: 54.1378 Precision: 54.3306 F1-Score: 54.234 Accuracy score: 88.7619 AUC Score: 73.8778

The accuracy scores might not be up to the mark, but this is the overall process of predicting loan default.

Code: Here

Conclusion

- The Random Forest approach is appropriate for classification and regression tasks on datasets with many entries and features that are likely to have missing values when we need a highly accurate result while avoiding overfitting.

- Furthermore, the random forest provides relative feature significance, enabling you to select the most important features. It is more interpretable than neural network models but less interpretable than decision trees.

- In the case of categorical features, we need to perform encoding so that the ML algorithm can process them.

- Predicting Loan Default is highly dependent on the demographics of the people, people with lower income are more likely to default on loans.

We are able to successfully perform the classification task using Random Forest Classifier. Hope you liked my article on predicting loan default.

The media shown in this article is not owned by Analytics Vidhya and are used at the Author’s discretion.