Ana Jovanovic

Updated on: December 2, 2024

Fact-checked by Kate Davidson

Venmo is a convenient way to send and receive money — but only if you’re in the US. The service requires both the sender and recipient to have US-based bank accounts, phone numbers, and be physically located in the US.

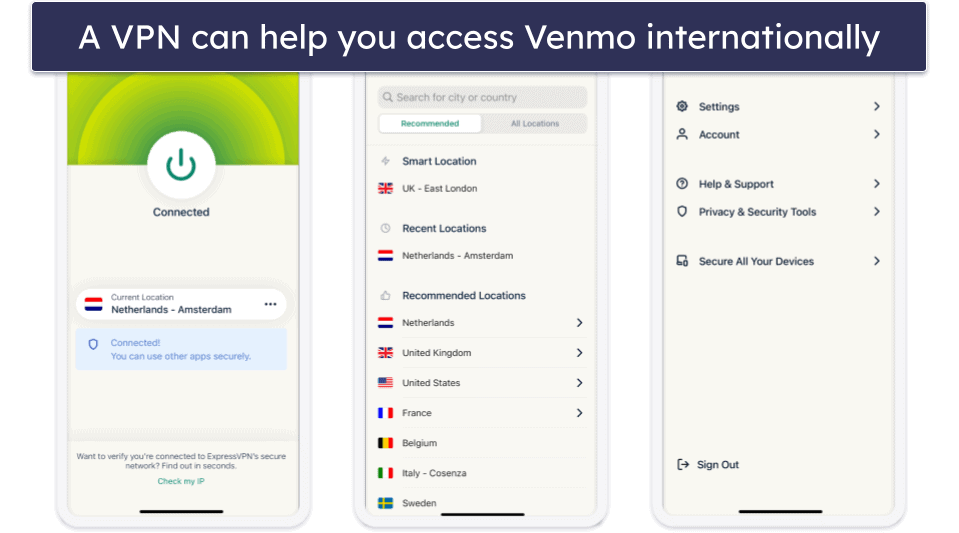

If you need to use your Venmo account from overseas, one option is to use a VPN. Top VPNs like ExpressVPN have many servers in the US, and you can connect to one of these servers to mask your location.

There are also plenty of good Venmo alternatives if you need to send money internationally or if you live outside the US. These include PayPal (Venmo’s parent company), Wise, and WorldRemit. Bear in mind though that some of these services charge transfer fees. Read on to learn more about sending money internationally. Editors’ Note: ExpressVPN and this site are in the same ownership group.

Can You Use Venmo Outside the US?

Though Venmo only works within the US, you can try using a VPN as a potential workaround. A VPN can mask your location by routing your internet connection through a US-based server, making it appear as though you’re accessing Venmo from within the US.

However, using a VPN doesn’t guarantee success. Venmo’s systems are designed to detect and block unauthorized access, so even with a VPN, your account may not work as intended while you’re abroad.

VPNs can also trigger security checks, leading to delays or even account restrictions. Additionally, a VPN won’t let you download the Venmo app if you’re outside the US. To use Venmo internationally, you must have already downloaded the app while in the US. And finally, if you encounter any issues, you won’t have Venmo’s customer support to turn to.

But if you already have the Venmo app installed and you want to try this approach, look for a reliable and fast VPN service like ExpressVPN.

Remember that even with a good VPN, you’ll still need a US-based bank account, phone number, and physical address to meet Venmo’s requirements. As a result, for most people outside the US, exploring alternative services could be a more straightforward solution.

How to Use a VPN to Access Venmo Internationally

As mentioned, you must first install the Venmo app on your phone while you’re in the US to use it abroad. If you don’t already have the app, you probably won’t be able to download it from outside the US.

If you do already have the app installed and want to try using a VPN to access Venmo from abroad, here’s how:

- Download and install a reputable VPN like ExpressVPN.

- Open the VPN app and choose a server based in the US.

- Once connected, open the Venmo app and use it as you normally would.

The Best Venmo Alternatives for International Money Transfers in 2024

Here are the best Venmo alternatives for non-US residents to help save time and avoid unnecessary fees while transferring money.

Wise

Wise is a great option for international money transfers. Its fees are generally a lot lower than some other services and banks. It uses local bank accounts in different countries to make transfers more affordable, and you can send money easily from the Wise website or app. Its multi-currency debit card also lets you spend money abroad without foreign transaction fees.

The service is transparent about its pricing as well. You can use its easy-to-use fee calculator to see exactly how much you’re sending in your local currency and how much the recipient is getting — even without signing up for a Wise account.

PayPal

PayPal is the most popular money app in the world, letting you send and receive money to most countries. You can transfer funds between bank accounts, debit/credit cards, and PayPal accounts.

While PayPal charges fees for international transfers, its wide availability, security, and support for multiple currencies make it a great choice. However, the fees can vary depending on where the sender and recipient are located. Sending money directly from your PayPal account to another domestic PayPal account is free, but fees apply when using credit or debit cards or converting currencies.

Overall, PayPal is a reliable option due to its availability on both desktop and mobile platforms. You can use the app on Android or iPhone, just like Venmo, but be prepared for potentially high and sometimes confusing fees.

WorldRemit

With WorldRemit, you can send money to 80+ countries, making it a great option for international transfers. You can send funds directly to bank accounts, mobile wallets, or even for cash pickups in certain locations, giving you flexibility in how you transfer.

Just like Wise, WorldRemit’s transparent fee structure and competitive exchange rates are a major plus. You can easily check the fees and exchange rates before completing your transfer using its fee calculator. Many transfers are completed in just minutes, so you won’t have to wait too long.

The app and website are easy to use, whether you’re on your phone or desktop. Fees can vary depending on where you’re sending money and how, but with its broad coverage and fast transfers, WorldRemit is a reliable option for sending money abroad.

Revolut

Revolut is a popular choice for sending money internationally, offering competitive exchange rates and low fees. It supports transfers to over 160 countries and allows you to hold and exchange multiple currencies within the app. Revolut also offers a multi-currency debit card that lets you make purchases abroad without foreign transaction fees.

The app is user-friendly, and you can quickly check the fees and exchange rates before making a transfer. Revolut also provides additional features like crypto trading, budgeting tools, and instant transfers between Revolut accounts.

Remitly

Remitly is designed specifically for international remittances, allowing users to send money from 30 countries to over 150 destination countries. It offers different delivery methods, including bank deposits, cash pickups, or mobile wallet transfers. Remitly is great for speedy transfers — they’re generally completed within minutes.

Remitly offers competitive fees, especially for bank transfers, but these can vary depending on the payment method and destination. The service also provides a transparent fee structure, so you can see the cost upfront before making a transfer.

How to Choose the Best Venmo Alternative for International Money Transfers

Here’s what to pay attention to when picking a Venmo alternative for transferring money abroad:

- Transfer fees: Fees can vary depending on the service, transfer method, and destination. Look for options that offer competitive and transparent pricing — particularly if you’re sending large amounts.

- Exchange rates: Aim for platforms that offer mid-market rates without hidden markups.

- Delivery speed: If time is a factor, consider how long it will take for the recipient to receive the money. Some services offer instant or same-day transfers, while others may take a few days.

- Multiple payout options: Depending on the recipient’s location, you might want a service that offers various ways to receive funds, such as bank deposit, mobile wallet, or cash pickup.

- Customer support and service availability: A reliable customer support team is essential, especially if something goes wrong with your transaction. Make sure that the service you choose offers accessible support channels like phone or even live chat.

- Security and trustworthiness: Choose a service that is regulated and uses encryption to protect your personal information. Verify that the service has a solid reputation and positive reviews to ensure your money is safe.

Frequently Asked Questions

Can you use Venmo internationally?

Venmo is only available within the United States, meaning it can’t be used for international payments. Both the sender and recipient need to be in the US, with US-based bank accounts and phone numbers. While you can try using a VPN to access Venmo abroad, it’s not guaranteed to work and could result in your account being restricted.

Instead, consider using alternatives like PayPal, Wise, or WorldRemit, which offer lower fees and greater availability in other countries. These services can help you send money internationally without facing the limitations that Venmo imposes on non-US users.

How much does Venmo charge for international payments?

Venmo doesn’t support international payments, so it doesn’t keep a pricelist for these. If you’re in the US and trying to send money internationally, Venmo won’t work. However, for domestic transfers, Venmo charges a 3% fee when using a credit card, while bank transfers are free.

Can I use Venmo in Mexico?

No, Venmo isn’t available outside of the United States. If you’re in Mexico or any other country other than the US, you won’t be able to send or receive money through Venmo.

To transfer money internationally, here’s how to pick a good Venmo alternative for international transfers. These options are widely accepted in Mexico (and many other countries) and provide a more reliable and cost-effective solution for sending money across borders.