This article was published as a part of the Data Science Blogathon.

The financial world has significantly started relying on Artificial Intelligence (AI) and Machine Learning (ML) algorithms to get accurate assistance in complex decision making. Likewise, the trading world is also moving forward to the appliance of algorithms to improve the occurrence and drive objectivity in financial business.

However, as the algorithms are outcomes of simultaneous data processing, research and as the machines treat every object individually, researchers say that the accuracy of algorithmic decision making often reduces. Most significantly, replicating human preference and admin preference on the algorithm code can let the algorithms make biased decisions.

What Is Bias in Algorithms?

In the language of statistics, a bias is a difference between the expected value of an estimator and its estimand. In simpler words, the influence that pushes results off the mark from the desired effect is called algorithmic bias.

Humans are the reason for Bias, not AI algorithms.

Algorithms do not make decisions; humans provide the algorithms with the data to process, and algorithms decide based on the data analytics.

For instance, an algorithm has been backtested with historical data of the admin traded the historical years. Now, the person in charge of the trading created exceptions for a particular trade. Say, 5 of each ten times sold it late. After the backtesting, the algorithm will undoubtedly notice the influence, and in future tradings, it’ll be late to sell the same or similar type of trade. That’s how bias in the algorithms happens.

Different Types of Algorithmic Bias and Their Solution

Bias can happen into algorithms in several ways and can appear at any state of AI processing. Also, knowing the bias’s range means how much the result is shifting because of the preference is essential to understand.

Primarily bias happens because of a particular group or data representation or under-representation, and this mainly occurs when multiple data sets are combined to use the sum.

Among the many sorts of bias types, here we will discuss some of the standard bias types and their solutions:

Data Mining Bias (Selection Bias)

This type of bias occurs because of the misuse of the sample data. While backtesting and mining data, considering a random occurrence as a potential opportunity and providing it significance is known as Data Mining Bias. Such occurrences can happen in the trade market coincidentally or because of unforeseen events.

To find a fruitful pattern, drilling over the same data repeatedly raises this type of bias. Algorithms often consider similar outlooks expecting to repeat similar events, and reacting the same in future events are likely to result negatively.

Solution:

You can run an out-of-sample test to determine the Data Mining Bias. If the results differ from the in-the-sample test, you know the curve of the bias. However, make sure that both samples don’t have any economic significance. Otherwise, the result could be similar.

Likewise, if you are looking for smoother and more efficient backtesting, in that case, you can use the MQL5 Cloud network for multithread testing, strategy optimization, and testing with different sets of data and various parameters.

Look-Ahead Bias

Also known as Peeking bias, it’s a type of backtesting bias that happens when the simulation leans on the information of data that was not available or known while the actual trading occurred. As a result, the bias leads you to an inaccurate result from the backtesting.

Fundamentally, it’s like executing an intraday trade based on the day’s unlikely closing price. Although the backtest often delivers the results close to the actual outcome, not the actual outcome. Also, the look-ahead bias is unlikely to be detected while backtesting an algorithm.

Solution:

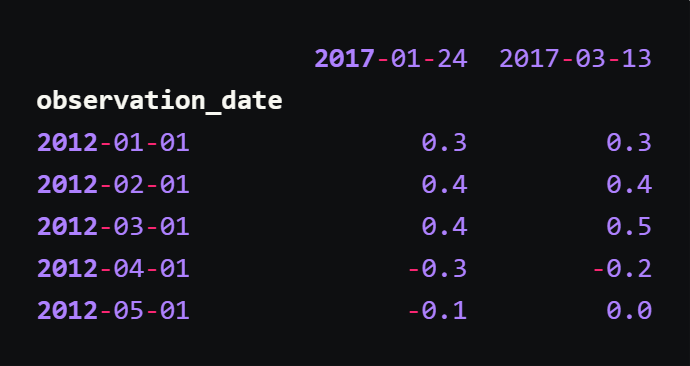

A comprehensive examination of the validity of the developed models and tactics is the most effective way to avoid the look-ahead bias. Besides, you can also use bitemporal modelling, which records the data in two different timelines.

Python Code:

import pandas as pd import urllib url = 'https://raw.githubusercontent.com/leosmigel/... analyzingalpha/master/2019-10-09-look-ahead-bias/unemployment.csv' with urllib.request.urlopen(url) as f: unemployment = pd.read_csv(f, parse_dates=True, index_col='observation_date') print(unemployment.head())

Code Output:

Optimization Bias

Optimization bias includes regular adjustment and the introduction of stable parameters until backtesting makes the data set attractive. However, when implemented, the strategy’s performance can be very different.

Solution:

It’s challenging to eliminate because of the different parameters used in algorithmic strategies to maintain entry/exit, lookback/average period, or measure volatility. However, keeping the parameter minimum and increasing the number of data sets could minimize the bias. It’s wise to run a sensitivity analysis to explore the surface of the performance. If it’s smooth, great, and jumpy, you need to readjust the parameters.

To find out the most suitable input parameters for your trading robot, increase profitability, stability and most importantly, to reduce bias, you can use the Trading Strategy Tester. It allows you to test advisors on multiple currencies and analyze them in only a few minutes. Besides, it solves mathematical errors of parameter optimization, and thus the testing of trading algorithms can be more realistic and bias-free.

Survivorship Bias

If the data used to train the model is of varying sample sizes, the results skew. It’s a typical selection bias and often occurs while backtesting any investment strategy for an extensive bunch of stocks.

Suppose testing the algorithm with ten years of stock data. Now, conceivably a few stocks have stopped trading or left the market after a short while. So the data sets don’t have complete information for ten years, creating a gap. Also, the bias gap still sustains if we remove the short stocks and only calculate trade with ten years of information.

Most trading indexes face the survivorship algorithm because it stops reporting the performance and analytics to the index when a fund falls.

Solution:

The immediate solution for the survivorship bias is to find datasets that include the delisted stock entities. However, they can be costly and possible for big financial firms to collect and employ. However, preferring to use recent data can help relieve the survivorship data.

If you want to avoid survivorship bias with your trading algorithm, you can operate the MetaTrader 5 platform for both forex and exchange markets. It has compelling algorithmic trading features and allows you to create your algorithm, backtest it, and trade bias-free.

Top Methods to Avoid Bias in AI Algorithms

The quote says that prevention is better than cure. Therefore, it’s wise to follow a few procedures to get negligible impairment from biased algorithms rather than struggling with a biased algorithm in the trading market and desperately looking for solutions.

Let’s discuss a few practical tips to avoid bias in your trading AI algorithms:

Use Neutral Dataset

The first and most important rule of avoiding bias is to use a straightforward and impartial dataset for your trading algorithm. If you use adequately managed and grouped clean data, the learning of the AI would be neat and bias-free. Also, if you have insufficient data for a specific category or group, then make sure to balance the data; otherwise, it may cause Exclusion bias.

Choose the Suitable Model

There can’t be a single algorithm model that will remain untouched to bias. Every AI has its significance, and thus each of them has its pros and cons. However, you can supervise them to get your desired result. As prevention is the best thing to do, early finding and fixing the bias seems like the best option.

Monitor Performance and Analysis

Testing is one of the most critical factors in machine learning and AI. Using the real dataset will expose all the possibilities and outcomes. An algorithm may seem like an elite force in a controlled environment, but the performance can turn when using real-life data. Hence, you should run it through real-life data and monitor the result variation.

Bottomline

Before everything, every algorithmic trader should understand the market’s characteristics, what condition the robot will perform, and the difficulties it will possibly face. Bias is the most common thing for an algorithm in the business.

However, you are expected to comprehend the algorithm bias and reduce it simultaneously. Then it becomes effortless for you to instruct your AI algorithms, avoid bias, and obtain your desired result.

Read more articles on Artificial Intelligence on our blog.

The media shown in this article is not owned by Analytics Vidhya and are used at the Author’s discretion.